Growing military electricity demand – driven by electrification of vehicles, systems, and infrastructure – poses new challenges for national energy systems. Without coordinated planning, this could strain grids, inflate costs, and compromise operational readiness. Host Nation Support adds further complexity, especially on frontline Allies. Ministries of Defence, Energy, and grid operators must work together to integrate military needs into long-term planning, invest in on-base generation, and enhance infrastructure resilience, including against hybrid threats.

NATO Allies rely on electricity supply to power estates and operations, and the way they consume it is changing rapidly. Electrification of the staff vehicle fleet is well underway, while demand is rising to support new technologies such as drones, advanced radar systems, and digital communications. Even combat vehicles are being considered for hybrid or fully electric powertrains, and directed energy weapons may soon see wider deployment. As a result, Allies must fully understand the long-term interaction between their demand profiles, national and local electricity systems, and wholesale energy markets.

Like civilian consumers, military entities have two primary options for securing electricity: generate it themselves or procure it from the grid. While many military estates and operational bases already generate electricity onsite – via diesel generators, renewables, or potentially nuclear power – most fixed infrastructure rely heavily on national electricity distribution networks. This creates a structural dependency: military capability is tied to the resilience of national grids and the ability of Distribution System Operators (DSOs) to balance loads effectively and reliably.

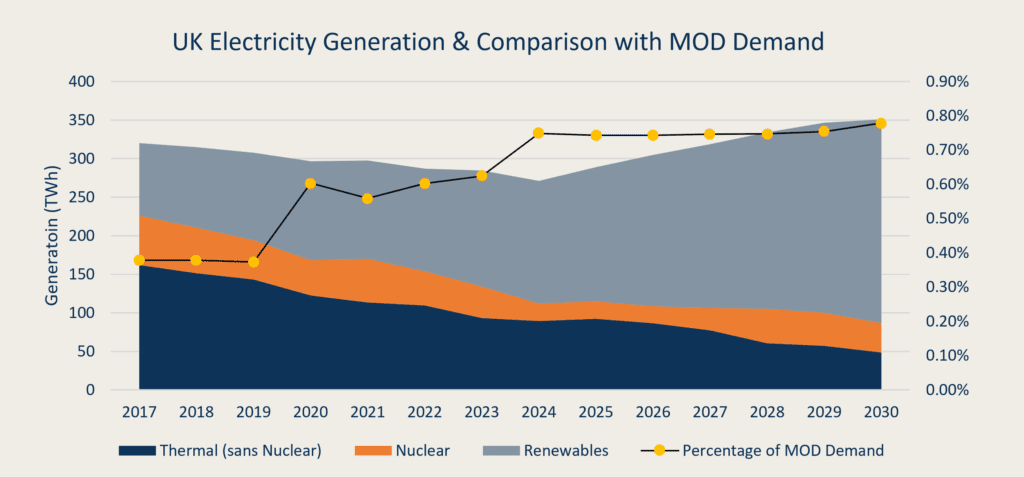

Data from the UK Ministry of Defence (MOD) shows a sharp 46% increase in electricity consumption between 2017 and 2023. If this trend holds across the Alliance – driven by the electrification of platforms, infrastructure, and technology – military institutions may cement themselves as the largest institutional consumers of electricity in their nations. On this trend, we could expect MOD to consume around 2.7 TWh annually by 2030, outlined in the graph below.

Source: NATO ENSEC COE Analysis of Historic Data Collated from MOD Annual Accounts

In 2017, the total electricity demand for the UK was around 300 times higher than the MOD’s consumption. However, given the projected rise in military demand, the MOD’s share of the total national electricity demand could approach 1% by 2030.

This rise in demand must be accommodated by electricity distribution infrastructure. As military electricity demand increases, local DSOs must continue to balance supply, demand, and system frequency. Large, inelastic loads must be taken into account to avoid disruption. That means infrastructure must be able to support it: the network of cables, substations, and transformers must be able to meet this changing load profile.

Source: DESNZ Energy & Emissions Projections

These issues can also impact the wholesale prices of electricity, especially as MOD consumption remains largely unaffected by price fluctuations. When large loads lack prices elasticity, it puts upward pressure on wholesale prices in a tight market. This means that reducing reliance on grid-sourced electricity – for example, through building out on-site renewables – can also have positive implications for civil consumers.

Moreover, following Russia’s full-scale invasion of Ukraine, the desire to decrease dependence on energy imports has become more prominent. With this in mind, the potential for military demand to outstrip national electricity generation growth might be a concern for Allies. The interconnectedness of European electricity markets allows for smooth distribution of power across borders; however, maintaining sufficient generation ability within borders is beneficial from a supply security perspective. If NATO nations’ generation capacities do not keep pace with growing military demands, it could increase reliance on imports, potentially destabilising energy supplies.

Source: NATO ENSEC COE Analysis of DESNZ EEP and UK MOD Annual Accounts data

If the percentage of MOD demand versus national generation increases, it becomes a more important part of the domestic power system (unless that demand is served by on-site generation). With that, the importance of electricity system resilience to national defence becomes even greater. This demonstrates why ongoing efforts to secure infrastructure against hybrid threats is critical for operational effectiveness.

Another key factor is Host Nation Support (HNS) – the civil and military assistance provided by a host country to NATO forces and institutions during peace, crisis, or conflict. As allied forces transit or operate within host territories, particularly on the Eastern Flank, they place growing logistical and energy burdens on host nations. These burdens may be expected to increase in the coming years. National military authorities are responsible for publishing a Capability Catalogue that outlines the personnel, equipment, and duration of support they can offer to NATO. It is critical for energy availability to be fully integrated into HNS planning.

To meet future demands, Ministries of Defence, DSOs, Transmission System Operators (TSOs), and Ministries of Energy must maintain strong, long-term partnerships. Each needs a long-term understanding of demand profiles under different scenarios – especially for surge or crisis conditions – and integrate them into national energy planning processes. This mitigates the risk of unanticipated burdens on infrastructure and supports more informed investment decisions.

Moreover, there is strategic value in increasing indigenous generation capacity at military bases. Deployable and modular energy systems – microgrids, mobile renewables, battery storage – can reduce reliance on national grids, enhance operational resilience, and increase flexibility in austere or contested environments.

Without coordinated foresight, NATO Allies risk facing operational constraints or placing stress on civilian energy systems at critical moments. A shared understanding of future military power demand – and the infrastructure, cybersecurity, and market conditions required to support it – must be a core element of both defence and national energy policy.

NATO ENSEC COE Support Field Test of Hybrid Generation System – strengthening onsite generation reduces reliance on grids and promotes resilience.

Holistic Civil-Military Energy Planning:

- Integrate military electricity demand into national energy planning

- Increase indigenous generation at military sites

- Address energy in Host Nation Support (HNS) planning

- Strengthen electricity system resilience against hybrid threats

- Coordinate with DSOs and TSOs under various scenarios