In January 2009, Russian gas supplies to Europe were halted for the first time since the system was built under the Soviets. The ensuing disruption led to the introduction of EU-wide gas security legislation which, it was hoped, would strengthen existing national frameworks. Amended and added to over time, these regulations offer useful – if limited – standards for assessing risks of supply failure. This article demonstrates the challenges of assessing how gas security might look in future. Key uncertainties remain regarding how nations will decarbonise natural gas consumption and how conflict may affect our security environment. It also outlines some of the ways in which we can strengthen our assessment of gas security. This is crucial given the critical role gas plays in generating electricity when renewables cannot, as well as keeping gas end-users warm during winter.

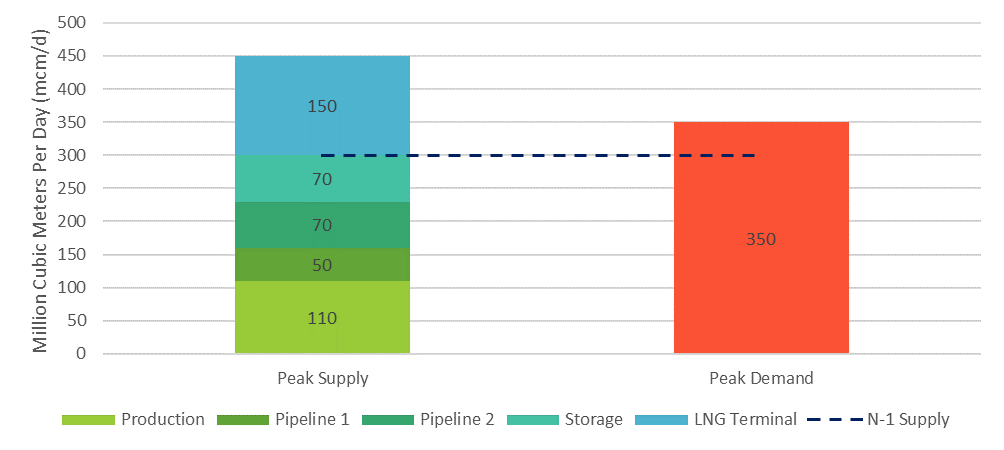

The Regulations the EU introduced obligated Member States to ensure their gas systems could meet the N-1 infrastructure test. For context, national gas systems can be supplied by gas produced domestically, import pipelines, Liquefied Natural Gas, or gas already in storage. Daily demand is affected by weather, commercial & industrial use, and the volumes needed to produce electricity. The N-1 test assesses the maximum quantity of gas which each type of supply can provide in one day. It compares this to the highest amount of demand that is likely once every 20 years. The test is whether supply is still greater than demand even without the largest piece of supply. If it isn’t, the system has failed. This implies it isn’t resilient and there is a risk to supply security.

An Example of a Failed N-1 Test. While aggregate peak supply is 100mcm/d above demand, there is an overreliance on the LNG terminal. Losing its 150mcm/d supply capacity would reduce peak supply to 300mcm/d, 50mcm/d below peak demand.

This test enabled the EU-wide assessment of gas security of supply. Its key benefits are its simplicity and the fact you can derive actions from the results. If your system fails, you should diversify supply and add capacity from another source, or reduce peak demand (e.g. by transitioning users away from natural gas).

It’s not a complete assessment, however (and probably was not intended to be). The biggest limitation is that “it fails to recognize the distinction between capacity and the physical availability of supply.” In other words, having enough gas pipes ready to receive the gas does not mean you actually get it. There could be a problem further up the supply chain, like a production outage. This may prevent the molecules from arriving at your supply points or, importantly, make them too expensive for you. Conversely, the availability of gas at the supply points does not mean that it can reach customers downstream. There could be bottlenecks further down the system before it gets to the user. This is especially a risk when demand points are dispersed from supply points.

So, a holistic assessment of gas supply must also assess further upstream and further downstream than the N-1 test. The UK has outlined one way this might be done. There, a new independent energy system planner and operator will conduct a medium-range gas security assessment. Government has proposed a methodology which that operator can amend. It recognises the importance of assessing gas availability as well as supply infrastructure. North Sea production forecasts are used to assess how much gas could reach national supply points in future. Including this type of upstream analysis adds flavour to the N-1 test. Together, they can show whether you have a sufficiently resilient national gas system, and whether you can be confident in securing the supply.

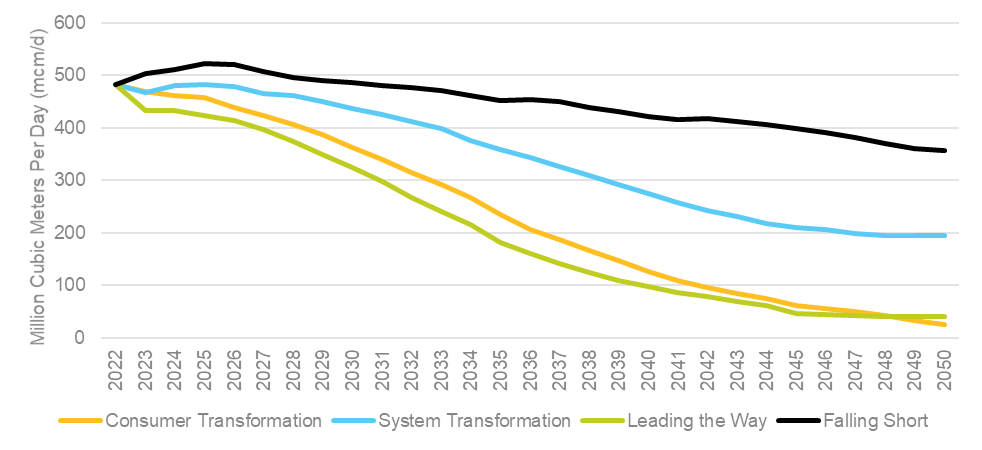

This approach, however, has the same challenge faced by any future-facing assessment: uncertainty of how the world will look in five and ten years’ time. Production is affected by demand, which is affected by production. In reality, the amount of gas that will be produced in future is impacted by how big the market is for it. If global demand decreases significantly during the energy transition, producers exit the market. You cannot be sure what future supply will be without being sure about demand, and vice versa. Credible future demand volumes vary significantly, as demonstrated on just a national scale below.

Peak (1-in-20) Gas Demand for Great Britain in Four Future Energy Scenarios.

Source: National Grid ESO Future Energy Scenarios 2023 (converted from TWh).

The problem isn’t solved if you can accurately predict your own national production and demand volumes. The global nature of the gas market means the volumes that are available to you from international markets – particularly LNG – are affected by worldwide supply and demand patterns. To confidently predict national flows you need an international picture which, ideally, includes a view of relative market prices. Ultimately, gas flows tend towards those who pay more than others.

That said, the goal isn’t necessarily to accurately predict future gas flows. Rather, it is to determine the level of risk. This can be done by comparing the credible supply with credible demand scenarios and identifying which combination may be problematic. This means that, despite the challenges it brings, a holistic assessment of future gas security must also consider supply availability alongside infrastructure availability. The UK’s new assessment is therefore a step in the direction.

Returning to the N-1 test itself, the question remains whether it is the right tool to gauge infrastructure resilience a national level. It is a useful benchmark which benefits from its simplicity. But, the world has changed significantly since the test was introduced in 2009 and updated in 2017. NATO recognises the increasing prevalence of hybrid threats and challenges from state and non-state actors to critical infrastructure. The N-1 test does not, by itself, encourage nations to think about which parts of the system are most critical. While it seems intuitive the largest part is of course the most critical, simple rules of thumb like this aren’t a valid way to determine which part of the network is most important to the function of the whole. There is a rich body of resilience literature which outlines how system operators might determine the critical parts of their infrastructure, beyond whether it constitutes the largest source of supply. System interdiction modelling may also add to the picture by showing where an efficient attacker might target to cause the most disruption to the gas network. This analysis, alongside the hybrid threat to energy infrastructure, is discussed in-detail at the NATO Energy Security Strategic Awareness Course, supported by the NATO ENSEC COE.

Nations can, therefore, add strength and depth to the N-1 infrastructure assessment. And, coupling this system resilience view with an assessment of future commodity availability, such as what the UK is planning to institute, could ensure that nations develop and maintain a more comprehensive public view of gas security than they ever have.

Climate change is an existential threat necessitating a change to way we use gas. Regardless, remaining customers – not only residents but gas-fired electricity generators – will need to secure gas supplies through the transition. We must avoid the immediate risk to life that comes with supply shortfalls, particularly in extreme weather. Holistic assessments of supply security and resilience enable us to make informed choices on whether and what type of remedial actions might be needed. All of this helps Allies keep the lights on and homes warm.